We’re now several weeks post transition period and like many others, we are starting to see what business actually looks like, this side of Brexit. Though experiences differ subject to our industries and the way we run our businesses, we thought it might be quite interesting to share how we’ve been impacted, now that reality is beginning to bite.

Despite the assurances given to us by the government, it’s unlikely any of us expected an entirely smooth transition as we left the single market, and it is fair to say that the run up painted a pretty confusing picture, complicated of course by the global pandemic in which we still find ourselves. As a result it is still quite difficult to untangle the effects of Coronavirus and those of Brexit on trade.

As a global supplier of fruit products, we import product into the UK from Europe, but also operate as a supplier between EU member states, which has posed its own set of problems (more on that later).

We face more paperwork, more regulatory checks and consequently more cost

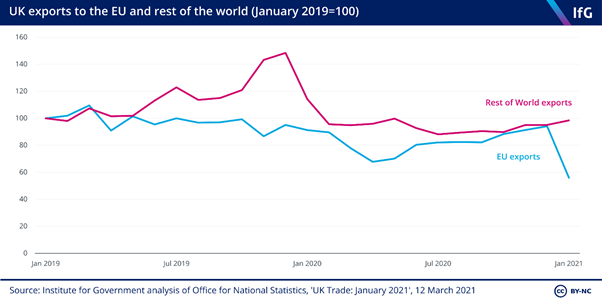

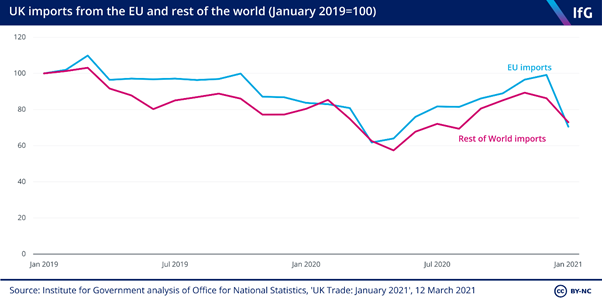

Inevitably, we face more paperwork, more regulatory checks and consequently more cost. Of course, those of us importing into the UK are still benefiting from the lighter touch to border checks, whilst those exporting into the EU have been dealing with the full set of import controls imposed by the EU since 1st January, which may explain why the official statistics on UK trade in January show a fall in trade between the UK and the EU, but with EU imports less affected than UK exports to the EU (for more see One month of data offers few clues about the longer-term impact of Brexit on trade | The Institute for Government)

We haven’t seen the end of this, of course. Full border checks for goods coming into the UK were due to be phased in by 1st July, but only last week the government announced a further delay on border controls for EU imports, most likely until the end of 2021. This was welcomed by some, but not by others. Whilst there’s a feeling that this approach is just kicking the can down the road, on the plus side it gives businesses like ours a bit more breathing space to hope for some stability to return as we start recovering from the effects of the pandemic, for example in relation to pressures from lengthy transit times and huge freight cost increases globally (more on that here).

As mentioned earlier, our own experience of the last few months also involves transactions in which we act as intermediary in intracommunity trade between different EU member states. This relates specifically to the treatment of VAT. It is not quite the M&S Percy Pig scenario (see Percy Pigs in Ireland hit by Brexit red tape as M&S warns of tariffs | Marks & Spencer | The Guardian) as the goods in which we trade don’t actually leave the EU – they are delivered directly to another EU member state, but it is a new found headache as formerly this arrangement benefited from simplified triangulation rules in which sales were treated as zero rated intracommunity supplies, and we, as the UK middleman, were not required to register for VAT in the country of arrival of the goods. Now we have left the single market, this no longer applies, and so there has been the additional hassle of obtaining VAT registration in different member states and ensuring we are compliant. Again, there’s very little guidance on this and consequently much toing and froing with trading partners and various authorities to get it right.

Businesses have a lot to contend with at the moment, and whilst there’s a general feeling that margins are being squeezed from every direction, there isn’t much choice but to adjust. We consider ourselves pretty fortunate; with long established relationships with growers, manufacturers, packers and customers all over the world and our own growing and processing operation in China, we can always source supply from different markets and our long experience importing into the UK from outside the EU stands us in good stead to deal with the changes still to come. But in light of the government’s latest announcements, it’s probably safe to say that the teething problems aren’t over just yet.